Both the National Living Wage and National Minimum Wage will increase in April 2019.

National Living Wage is the statutory minimum hourly rate that workers aged 25 and over are entitled to and applies to all eligible workers even if they’re not paid by the hour.

The National Minimum Wage is the minimum pay per hour most workers under the age of 25 are entitled to by law.

This means that however you get paid, you still need to work out your equivalent hourly rate to make sure you are receiving the correct pay.

There are different ways to check to see if you are being paid the national minimum wage depending on whether you are being paid an annual salary, being paid by the piece or ‘output work’ or if you are paid in other ways – known as ‘unmeasured work’.

Who Is Not Entitled To National Minimum Wage or National Living Wage?

Some workers that are not eligible for the National Living Wage or National Minimum Wage. If you are a member of the employers family and reside in the family home and share in the tasks and activities of the family you are not entitled to Minimum or Living Wage. This also applies if you are living in the family home and not a family member but are treated as such and provided with accommodation, meals and the sharing of tasks and leisure activities.

National Minimum and Living Wage do not apply to self-employed people, volunteers or voluntary workers, company directors, members of the armed forces, work experience students, depending on the length of their placement.

Agricultural and horticultural workers in England employed after 1st October 2013 must be paid the appropriate pay rate. If they were already employed before 1 October 2013, they will still be entitled to the same terms and conditions set out in their contract of employment. Agricultural and horticultural workers in Scotland and Wales must be paid the highest rate that applies to them from the Agricultural Minimum Wage, the National Minimum Wage or the National Living Wage.

All other workers including people who work from home, agency workers, people who work part-time and casual workers must receive at least the National Minimum Wage or National Living Wage. You may need to have adjustments made to your Minimum Wage if you live in accommodation which is linked to your employment or owned by your employer.

Non-payment of the National Living Wage or National Minimum Wage

It is against the law for employers to pay workers less than the National Living Wage or National Minimum Wage. If your employer isn’t paying you the correct pay rate you should speak to them and try and resolve the matter. If this informal approach doesn’t work, you have the option of raising a formal written complaint also known as a grievance.

If your complaint isn’t resolved, you could choose to make a complaint to an Employment Tribunal.

Alternatively, you can make a complaint to HMRC who will investigate the matter. This can be done anonymously. If HMRC find that an employer hasn’t paid at least the National Minimum Wage, they can send a notice of arrears plus a penalty for not paying the correct rate of pay. You can either pursue the issue through the Employment Tribunal OR a complaint to HMRC – you cannot do both.

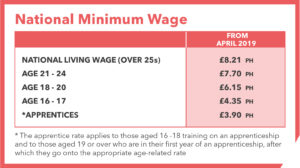

How Much Will The National Minimum Wage and National Living Wage Increase To?

The rate will depend on your age and if you are an apprentice.

The National living wage is to increase by 4.9% from 1st April 2019 from £7.83 to £8.21.

The Low Pay Commission estimates that the increase will benefit around 2.4 million workers. The Treasury says the annual earnings of a full-time minimum wage worker will have increased by over £2,750 since the introduction of the National Living Wage in April 2016.

The minimum hourly pay rate for those aged between 21-24 will increase from £7.38 to £7.70 an hour. There is also an increase in the rate for 18-20 year olds to £6.15 an hour and those over compulsory school age (but not yet 18) will see an hourly pay rate increase to £4.35. If you are an apprentice, your pay rate will also increase to £3.90 an hour; you must be under the age of 19, or 19 and over but in the first year of your current apprenticeship.

At Personnel Placements we pay all of our temporary workers the National Living wage – no matter how old they are. As a temporary worker, once eligible. you are also auto enrolled into a pension scheme. To learn more about working as a temporary worker, holiday pay and the benefits of temping head over to our blog page.

You can find more advice on this on the Government website.