With April fast approaching, the UK is on the brink of significant changes in its wage landscape, with adjustments to both the national living wage and the minimum wage. While these changes promise to uplift millions of workers, employers must also grapple with the implications for their businesses. Here we look at how the impending wage increases will impact both employees and employers alike.

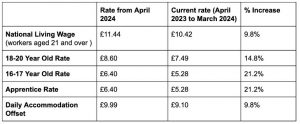

The UK’s national living wage is set to rise from £10.42 to £11.44 per hour come April, benefiting nearly three million individuals and extending eligibility to those aged 21 and 22. Concurrently, revisions in the minimum wage will ensure alignment with the national living wage for individuals within the same age bracket. Accommodation provided by an employer can be taken into account when calculating the National Minimum Wage or National Living Wage. No other kind of company benefit (such as food, a car, childcare vouchers) counts towards the minimum wage.

Implications for Employers

The increase in wage levels translates to higher operational costs for employers. As wages constitute a substantial portion of expenditure, businesses must recalibrate their budgets to accommodate the impending rise. This may entail revisiting pricing strategies or implementing cost-saving measures to maintain profitability amidst escalating wage bills.

With wage levels on the rise, employers face the challenge of remaining competitive in the talent market. To attract and retain skilled workers, businesses may need to review their compensation packages and explore non-monetary incentives. Failure to address these concerns could lead to difficulties in talent acquisition and retention, impacting overall workforce dynamics.

While higher wages can incentivise greater employee productivity, there’s a risk of escalating labour costs outpacing efficiency gains. Employers must focus on optimising operational processes and investing in technologies to enhance workforce productivity. Strategic initiatives aimed at upskilling employees and streamlining workflows can help mitigate the impact of rising wages on overall efficiency.

Ensuring compliance with wage regulations is imperative for employers. With changes in wage levels, businesses must update their payroll systems and practices to reflect the new rates accurately. Non-compliance can result in legal repercussions, including fines and reputational damage, underscoring the importance of adherence to statutory wage requirements.

Strategic Planning for the Future

Amidst these changes, employers must adopt a proactive approach to workforce management and strategic planning. This includes forecasting future wage trends, conducting scenario analyses, and developing contingency plans to navigate potential risks effectively. By staying ahead of the curve and aligning business strategies with evolving market conditions, employers can position themselves for sustainable growth and success in an ever-changing economic landscape.

If you would like help and support with workforce planning please give Lynne a call!