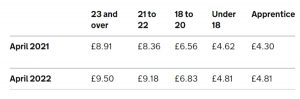

The National Living Wage paid to workers aged 23 and over increased on the 1st April 2022 from £8.91 per hour to £9.50 per hour, which in real terms means an increase of 59 pence per hour and an extra £1,000 per year if you work full-time. The national minimum wage for workers aged under 23 and apprentices has also increased.

How Have National Living and Minimum Wage Rates Changed?

The National Living Wage is the lowest amount that can legally be paid to employees aged 23 or over and is adjusted each April. The age at which workers become eligible for the national living wage was reduced in April this year, from 25 to 23, and is currently higher than the compulsory minimum wage, which is for those aged 22 and under.

Is Real Living Wage Different?

The Real National Living Wage is an amount calculated by the Living Wage Foundation as the minimum pay workers and their families need to live and is currently £9.50 per hour across the UK and £10.85 per hour in London, for anyone aged over 18

The Real Living Wage is voluntarily paid by almost 9,000 UK employers and it’s estimated more than 300,000 workers will receive a pay rise as a result of the increase.

Across the UK other than London – the real living wage rate has risen by 40 pence per hour – from £9.50 per hour to £9.90 per hour.

In London, the real living wage has risen by 20 pence per hour- from £10.85 per hour to £11.05 per hour.

Changes to National Insurance

In addition to Minimum Wage and National Living wage changes, National insurance contributions will rise from the start of the new tax year.

National insurance is a tax paid on earnings by employees and employers and paid by the self-employed on profits.

National Insurance was first introduced in 1911 to support workers who had lost their jobs or needed medical treatment, and it was later expanded to fund the state pension, other benefits and contribute towards the NHS.

National insurance contributions are mandatory for people aged 16 or over, up until state retirement age, provided you earn over certain limits.

The changes come into effect on Wednesday 6 April and the rate at which you pay national insurance will go up by 1.25 percentage points. This means that most employees will see their national insurance contributions increase from 12% to 13.25%.

Earnings above £4,189 a month (£50,270 per year) are usually subject to national insurance deductions of 2%. But from 6 April this will increase to 3.25%.

Changes to Employers NI Contributions

Employers’ National Insurance contribution will also be increasing by 1.5% from April 2022. This means the rate for employers will stand at 15.3% on all earnings above the secondary threshold for most employees.

NI and Tax Thresholds

From July the National Insurance Contributions threshold will increase and be the same as the income tax threshold. This means you won’t pay national insurance or income tax if you earn below £12,570 a year. If you earn more than this, you will still feel the benefit as you will pay less national insurance overall due to the higher threshold.

More information on the increases in National Minimum and National Living age as well at National Insurance contributions and thresholds can be found on the government website.